What is Making Tax Digital for IT, and do I fit?

Making Tax Digital (MTD) for Income Tax (IT) is the next stage in HMRC’s plan to modernise the UK tax system, making it easier for people to get their tax right. It means individuals and businesses will need to use MTD-compatible software to keep digital records and submit returns.

You will be mandated to report your income and expenses via MTD for IT if you are self-employed or a property landlord with a total combined turnover from all businesses exceeding £50,000 per year. For example, if you have self-employed income of £26,000 and property income of £25,000, these combined exceed the £50,000 threshold, so the MTD for IT requirements will apply.

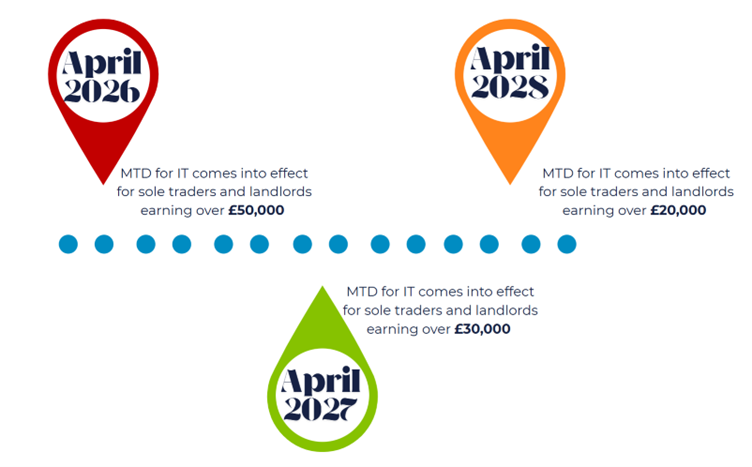

HMRC will look at turnover over £50,000 in the 2024/25 tax year. If your qualifying income exceeds £50,000, you will fall into the scope of MTD for IT and will need to start reporting your income digitally from 6 April 2026.

Making Tax Digital for Income Tax Timeline

What are the main changes to the submission requirements?

If you fit this criteria, for each business, you will have to:

- Keep digital records on MTD compatible software of all business income and expenditure

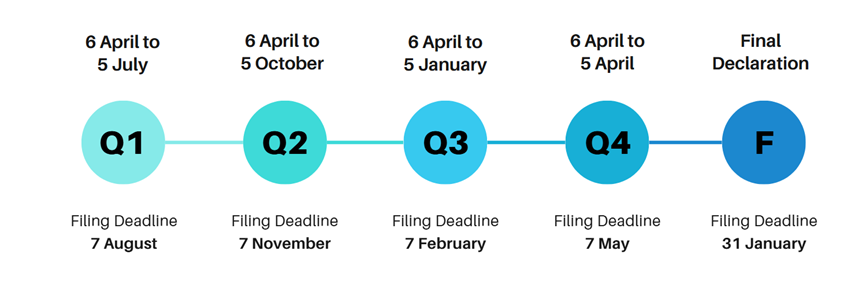

- Submit quarterly updates to HMRC

- Submit a final declaration that includes all other taxable income by the usual 31 January deadline. This is where you must report any additional income sources, such as investments or savings, as well as file any claims for relief.

- Pay your tax by the same deadline, 31st January following the end of the tax year, e.g. Tax year 2026/27 payment will be due by 31st January 2028.

These quarterly submissions are in line with the tax year. All businesses will need to report for these quarters regardless of their accounting period end.

MTD for IT Submission Timeline

What are the penalties for late or incorrect submissions?

MTD for IT will follow the same penalty point system as MTD for VAT. This penalty system has not been amended.

Each missed filing deadline results in one penalty point. Accumulating four points triggers a £200 fine.

Additionally, penalties apply for late payments. If tax remains unpaid after 15 days, a 3% charge is levied on the outstanding amount. After 30 days, an additional 2% charge is applied, this is alongside the initial 3% from day 15.

Should the tax still be unpaid after 31 days, a daily accruing penalty of 10% per year on the outstanding amount is imposed.

Penalties will expire after two years from the month they were issued; however, if you reach the penalty threshold of four points, they will not reset until you file on time for 12 consecutive months and bring all older submissions up to date.

Challenges you may face with MTD

- Converting manual records to a digital version (ie, Cashbooks)

- Converting spreadsheets into recognised cloud accounting packages

- Keeping software that will link directly with HMRC (ie, Xero or Hammock)

- Additional costs associated

- Additional time for processing