On the 3rd March 2021, in his budget speech, the Chancellor announced a new “super-deduction” scheme, which allows companies to claim up to 130% deduction against profits for any new and unused plant and equipment. This equipment must have been purchased between 1st April 2021 and 31st March 2023.

The super-deduction scheme will allow companies to cut their tax bill by up to 25p for every £1 they invest, ensuring the UK capital allowance regime is amongst the world’s most competitive. A super-deduction providing allowances of 130% on most new and unused plant and machinery investments that could ordinarily only qualify for 18% in year one.

Why has the government introduced super-deductions?

The super deduction tax scheme is intended to spur business investment, boost the UK’s post-pandemic economic recovery and improve the country’s productivity over the next two years. This scheme should lead to more corporate profits for the government to tax in 2023. The government hopes that the super-deduction will give companies a strong incentive to make additional investments and to bring planned investments forward.

Who qualifies for super deductions?

To claim the Super Deduction allowances, a company must be within the charge to Corporation Tax. Expenditure on qualifying assets must be incurred between 1 April 2021 and 31 March 2023 and the allowances only apply to contracts entered into after 3 March 2021.

What Expenditure Qualifies for Super Tax Deduction?

The Super Deduction applies to new plant and machinery that ordinarily qualifies for the 18% main pool rate for writing down allowances.

Examples of qualifying plant and machinery include:

- Computer equipment and servers

- Tractors, lorries, vans

- Ladders, drills, cranes

- Office chairs and desks

- Electric vehicle charge points

- Refrigeration units

- Compressors

- Foundry equipment

- Vehicles used for trading purposes(not cars)

What are capital allowances?

Capital allowances let taxpayers write off the cost of certain capital assets against taxable income. They take the place of accounting depreciation, which is not normally tax-deductible.

Businesses deduct capital allowances when computing their taxable profits. In translating its accounting profits into taxable profits, a business is usually required to ‘add back’ any depreciation, but can instead deduct capital allowances.

For example, a corporation tax paying company with accounting profits of £1,000, depreciation expense of £200 and total capital allowance claims of £300 would make the following adjustment:

- Add £200 (depreciation expense) to £1,000 (accounting profits) = £1,200

- Deduct £300 (capital allowances) from £1,200 = £900 (taxable profits)

- Apply the appropriate tax rate, e.g. corporation tax at 19%: £900 x 19% = £171 tax due

The two main types of capital allowances are:

- Writing Down Allowances (WDAs) for plant & machinery - covering most capital equipment used in a trade

- Structures and Buildings Allowances (SBA) - covering the construction and renovation of non-residential structures and buildings.

The 130% super-deduction is a generous new capital allowance for investment in plant and machinery assets. It will allow investing companies to lower their corporation tax bills.

What is classed as plant and machinery?

Most tangible capital assets used in the course of a business are considered plant and machinery for the purposes of claiming capital allowances. There is not an exhaustive list of plant and machinery assets.

The kinds of assets which may qualify for super deduction, but are not limited to are:

- Solar panels

- Computer equipment and servers

- Tractors, lorries, vans

- Ladders, drills, cranes

- Office chairs and desks,

- Electric vehicle charge points

- Refrigeration units

- Compressors

- Foundry equipment

How much tax relief do you get?

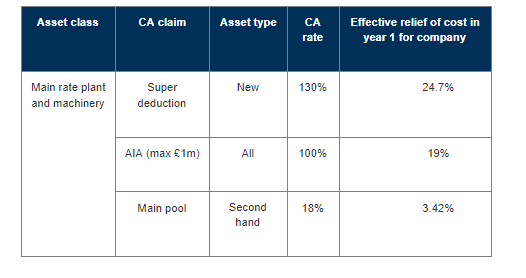

The super deduction gives relief at 130% of the qualifying cost compared to the usual 18% writing down allowance for investment in main pool plant and machinery assets.

The table below shows the effective rates of relief for the different claims but, as always, your capital allowance claims for each year will need to be compiled with care to ensure that your business gets the most optimised benefit overall.

How does it work?

The new tax relief is being introduced for two years for expenditure from 1 April 2021 to 31 March 2023 – sadly it’s only a temporary measure. Let’s say your business spends £100,000 on main rate equipment and you’re eligible to claim the super-deduction tax break on this expenditure. When you calculate your taxable profits your corporate tax deduction will be £130,000 (i.e. 130% of your initial investment). Deducting £130,000 from your taxable profits will save your business up to 19% of that – 19% of £130,000 is £24,700. And that’s how much corporation tax you save if you qualify for super-deduction.

From an accounting perspective, our advice for businesses looking to maximise your tax savings is to plan well ahead.

Examples of super deductions

Example one

- A company incurring £1m of qualifying expenditure decides to claim the super-deduction

- Spending £1m on qualifying investments will mean the company can deduct £1.3m (130% of the initial investment) in computing its taxable profits

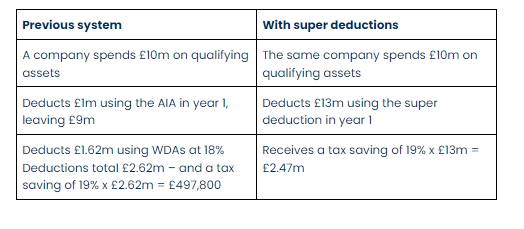

- Deducting £1.3m from taxable profits will save the company up to 19% of that – or £247,000 – on its corporation tax bill. Example two Previous system With super-deduction

Example two

Speak to our expert tax team today to find out how we can help your business