What are R&D tax credits?

First of all, let’s explain what R&D Tax credits actually are. They are a government scheme that rewards UK companies for conducting research and development. It allows up to 33.35% of a company’s R&D spend to be reimbursed either as a reduction of Corporation Tax or cash repayment. Since the Government launched the scheme more than 20 years ago, the R&D Tax Credits Scheme has paid out £33 billion to tens of thousands of companies.

What are the benefits of claiming R&D tax credits?

- Unique selling point - R&D can help you develop unique products and services.

- Income - unique products and services resulting from successful R&D projects can bring financial benefits to the business. R&D can also attract potential new investors to your business.

- Funding - R&D can also offer many opportunities for businesses to seek public-sector innovation, research and development grants or even global funding and support for innovation.

- Tax relief - You can choose to receive a tax credit instead by way of a cash sum paid by HM Revenue and Customs. Only qualifying R&D expenditure will be considered for tax relief purposes.

- Competitive edge -You can develop an advantage over your competitors and establish yourself as leaders in the market. The development of new products and services can also generate new intellectual property for your business which could further benefit you financially.

- Reputation - engaging in R&D can help you strengthen your brand and reputation. If you're collaborating with a trusted, reputable partner or a strong scientific institution, the commercial success of resulting products and services can benefit from their involvement.

Who can claim R&D tax credits?

Many companies are often surprised to find out that they are eligible for claiming R&D tax credits as the eligibility criteria are a lot broader than they first thought. The scheme applies not only to product development but also to activities and operations, such as new manufacturing processes, software development, and quality assurance enhancements.

Your company could be eligible for the R&D tax credit if it:

- Devotes time and resources to creating new or innovative products

- Improves existing products

- Develops processes, patents, prototypes, or software

- Hires designers, engineers, or scientists

Every year more than 60,000 UK companies successfully claim upwards of £5 billion worth of R&D Tax Credits. Although this is a large number of businesses the scheme is governed by a strict set of eligibility criteria:

- You must be a limited company and registered to pay corporation tax in the UK. Sole traders, partnerships, and public liability companies are not eligible

- The work that qualifies for R&D relief must be part of a specific project to make an advance in science or technology. It cannot be an advance within a social science - like economics - or a theoretical field - such as pure maths.

- The project must relate to your company’s trade - either an existing one or one that you intend to start based on the results of the R&D.

To get R&D relief you need to explain how a project:

- looked for an advance in science and technology

- had to overcome uncertainty

- tried to overcome this uncertainty

- could not be easily worked out by a professional in the field

Your project may research or develop a new process, product or service or improve on an existing one.

What are the different types of R&D relief?

There are different types of R&D relief, depending on the size of your company and if the project has been subcontracted to you or not.

Small and medium-sized enterprises (SME) R&D Relief

You can claim SME R&D relief if you’re an SME with:

- less than 500 staff

- a turnover of under 100 million euros or a balance sheet total under 86 million euros

You may need to include linked companies and partnerships when you determine if you’re a SME.

R&D relief allows companies to:

- deduct an extra 130% of their qualifying costs from their yearly profit, as well as the normal 100% deduction, to make a total 230% deduction

- claim a tax credit if the company is loss-making, worth up to 14.5% of the surrenderable loss

Research and Development Expenditure Credit

This replaces the relief previously available under the large company scheme.

Large companies can claim a Research and Development Expenditure Credit (RDEC) for working on R&D projects.

It can also be claimed by SMEs and large companies who have been subcontracted to do R&D work by a large company.

What can I claim as R&D?

The main reason many businesses across the UK are missing out on R&D tax relief is because they simply don’t understand what they can and can’t claim for. This is the main part of the application and can help the future of your business by saving vital funds.

In most instances you can claim R&D relief on revenue expenditure this includes; day to day operational costs, the cost of using or creating a trademark, production, and distribution of goods and services within claim.

To make this simple for you we have listed below some of the key areas which you can claim R&D tax relief for:

- Direct staff costs- employees who have worked directly on R&D projects. This includes wages, overtime, cash bonuses, employer NI and employer pension contributions.

- Software- Any software which was needed for R&D or involved in R&D activities can be included. But it must have been developed or purchased specifically for the R&D project.

- Materials and resources- Such as water, fuel and power can be included if they are consumed in your R&D process.

- Consumables – Materials and resources that are used up / consumed in your R&D process, such as water, fuel and power can be included in your claim

- Outsourced R&D- if part of your project has been outsourced to another company for an agreed amount you can include this in your claim.

- Clinical volunteers – Usually only relevant to pharmaceutical firms, the payments made to volunteers in clinical trials are eligible.

How much can I claim?

We have put together a handy R&D Tax calculator which is free to use on our website. This can help you calculate how much you could be saving and claiming through the R&D Tax relief system

What is not classed as R&D ?

You can’t just label an activity as R&D and hope to be able to access the tax relief. Many companies get quite a shock when HMRC rejects their claims because the activity simply doesn’t meet the HMRC criteria.

It is very common for companies to invest in new machines, new software, and experiment with new technologies. However, just because something may be new for the company does not necessarily mean it is R&D. It is important that you speak to a specialist who truly understands the criteria and application process before risking submitting a false claim.

How do I apply for R&D?

It is crucial that when you apply for R&D tax credits that your application is fully compliant and fully-maximised for your claim. This process can be complicated and any mistakes made could end up facing an HMRC enquiry and a delay of up to six months.

Therefore, if you are keen to make sure your claim is fully compliant and makes it possible for you to claim for all your activities effectively it is a good idea to speak to a team of professionals.

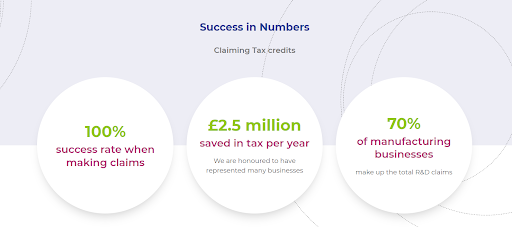

Our team of experts at Pierce have a 100% success rate when making claims and have saved £2.5 million in tax for an array of businesses across the UK.

What happens after I apply?

After you have applied to claim R&D tax credits, an HMRC tax inspector will begin to review your companies claim, including your technical narrative and financial calculations,

If your claim is successful you will receive written confirmation from your inspector that they have processed your cash credit or tax reduction. HMRC state they aim to process 95% of claims within 28 days. Once your claim has been processed you could then be waiting another 20 days to receive your money. The whole process on average can take around 120 days to receive your R&D Tax Credits.